Table of Content

They are an example of revolving debt, where the outstanding balance can be carried month-to-month, and the amount repaid each month can be varied. Examples of other loans that aren't amortized include interest-only loans and balloon loans. The former includes an interest-only period of payment, and the latter has a large principal payment at loan maturity. Most lenders allow you to roll the closing costs of the refinance into the balance of your new loan, increasing the total amount borrowed. Apply with at least three lenders and obtain official Loan Estimates to compare loan costs and savings.

Here are some details about the most common types of loans and the loan calculators that can help you in the process. In lending terms, it is a way of spreading out the payments that you need to make when making a large purchase, such as a house. Similar to assets that depreciate in value, liabilities such as loans and repayments also depreciate in value.

Vehicle loans

Every loan you take comes with their own eligibility factors that, as an applicant, you have to fulfill. Apart from that, you should also know the amount you can comfortably pay as EMI every month. Owing to this, a Housing Loan Calculator India can give you an idea of what will be your monthly payments, before you have actually applied for the home loan. Home Loan EMI can be defined as the monthly payment you have to make in order to repay your home loan. This repayment has a term in which you have pay back the loan and it can be calculated with the help of a Home Loan EMI Calculator, EMI is Equated Monthly Installments. Loan approval is subject to credit approval and program guidelines.

So you need to build a rainy day fund, because odds are against you that one day the air conditioner will fail or the roof will leak or one of your major appliances will go on the blink. Without an emergency fund, these types of events can put you in the red. Lawn mowers, weed whackers, hedge trimmers, etc. will be an immediate expense. If you live in a neighborhood with a homeowners association, monthly or quarterly fees may be required.

Loan Payment Calculator With Amortization Schedule

Click on the print/download button to Download your home loan EMI calculation and home loan amortization schedule. If you are a renter, you are accustomed to charges for utilities, but if you move into a larger house, be prepared for a larger heating and cooling bill. If anything needs repaired, you are responsible for all the parts and installation.

Home loan interest rates with further options for you to choose between fixed or floating rates throughout the loan tenure. Next, select the repayment period which can be up to 5 years or 60 months. You are required to pay 10-25% of the total property cost as ‘own contribution depending upon the loan amount. 75 to 90% of the property cost is what can be availed as a housing loan.

Business loans and lines

When the equity in your house reaches 20% the PMI can be removed, so this is another reason to choose the 15 year option - where your equity builds faster. Enter your original loan amount, interest rate and length of the mortgage in the places indicated. The calculator will immediately show your monthly payments and a breakdown of your total costs and interest costs in the "Total Payments" box further down. How long you take to pay off the loan depends on the terms of the loan. Most lenders tend to amortize personal loans over 3-5 years, although nothing in the law requires this.

Thus, a borrower may first need to check with the lending bank to see if utilizing such strategies is allowed. You can also speed up your loan repayment to a bi-weekly cadence, which many lenders allow. Bi-weekly payments equate to one extra payment each year and 51 fewer months on a 30-year loan. Before signing, confirm a bi-weekly payment option with your lender.

Total Payments $266,287

A secured loan requires the borrower to put up an asset as collateral to secure the loan for the lender. If you don’t make your car payments, the lender will repossess the car. An amortization table or schedule is basically a chart that details the amount you must pay over the period of the loan you have taken to buy a house. It includes the total value of the loan taken, the monthly EMI that you have to pay, and the breakup of that monthly instalment into a principal and interest amount. There is a possibility that after payment of conversion fees, your bank is offering the interest rate same as offered to the new borrowers. At the same time, it might be higher than the interest rates offered by market leaders.

The loan against property is also called the mortgage loan as it is secured against immovable property. Apply for forbearance if your income suspension is temporary – Arrange with your lender to temporarily suspend your monthly payments for a specific period of time. At the end of the forbearance period, you agree to continue paying the monthly mortgage payment plus the aggregate amount you missed. Your lender will assess your situation if you qualify for the forbearance plan and they will dictate the terms. In most cases, the amortized payments are fixed monthly payments spread evenly throughout the loan term.

"I have been a member of GHS FCU for 5 years now. Their online banking and online loans are easy to use. The branch employees are great. Refinancing will save you per month and save you in total cost. Borrowers with the best credit profile usually get the best interest rates. Although the breakup between the principal amount and the interest will be different every month or a few months, the total amount to be paid each month will be the same.

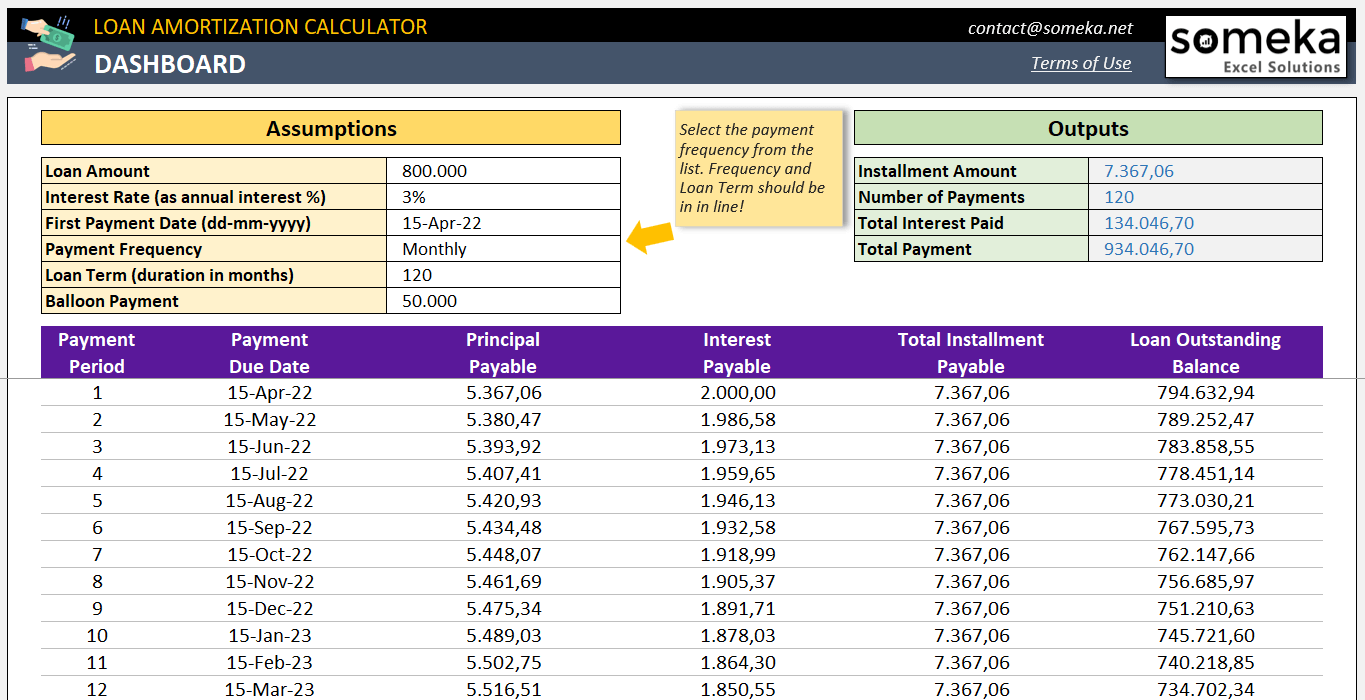

Download this Excel loan calculator and take charge of your financial obligations. This loan calculator - also known as an amortization schedule calculator - lets you estimate your monthly loan repayments. It also determines out how much of your repayments will go towards the principal and how much will go towards interest. Simply input your loan amount, interest rate, loan term and repayment start date then click "Calculate". First enter the amount of money you wish to borrow along with an expected annual interest rate. Click on CALCULATE and you’ll see a dollar amount for your regular weekly, biweekly or monthly payment.

No comments:

Post a Comment