Table of Content

Receive the best home equity and mortgage rates every month right to your inbox. Here is a tool from Fullerton India to help you understand and visualize what a personal loan amortization could look like. Real Estate Taxes – Property taxes the government imposes based on a percentage of the value of your home. Mortgage Loan Term – The number of years you are required to pay your mortgage loan.

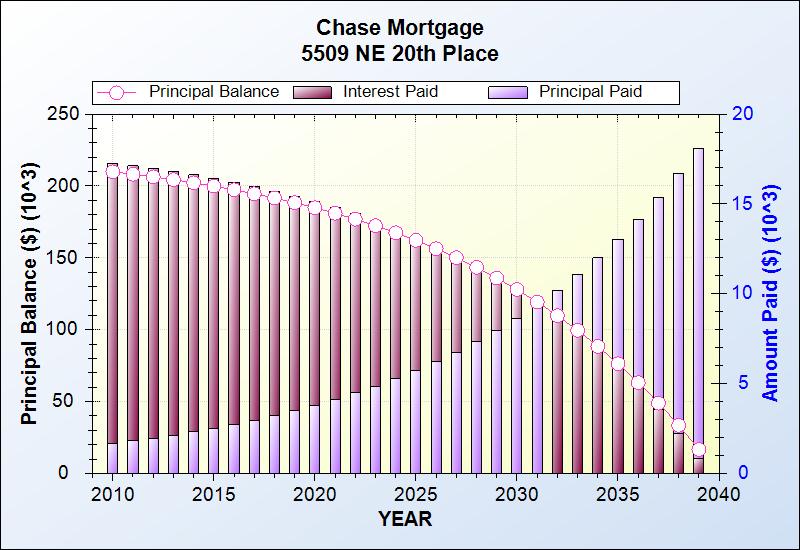

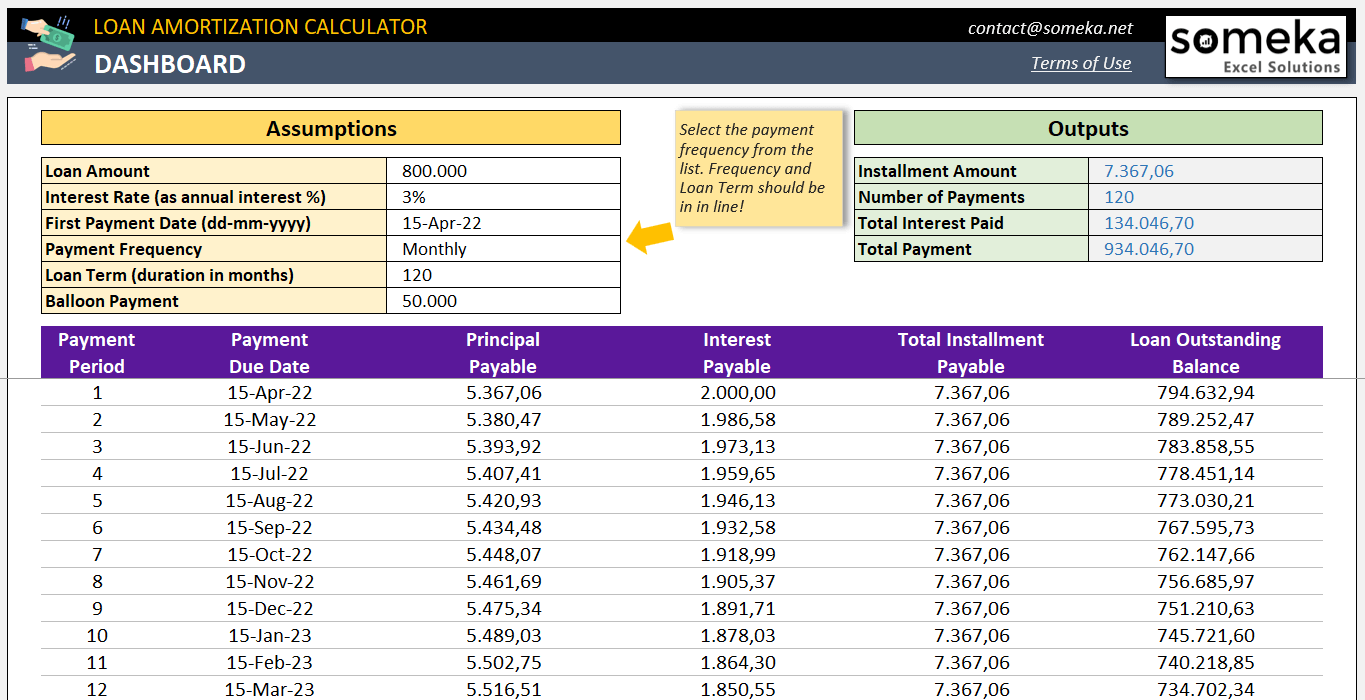

See the differences and how they can impact your monthly payment. This calculator will compute a loan's payment amount at various payment intervals -- based on the principal amount borrowed, the length of the loan and the annual interest rate. Then, once you have computed the payment, click on the "Create Amortization Schedule" button to create a chart you can print out. For example, a borrower who has a $150,000 mortgage amortized over 25 years at an interest rate of 5.45% can pay it off 2.5 years sooner by paying an extra $50 a month over the life of the mortgage. The amortization chart shows the trend between interest paid and principal paid in comparison to the remaining loan balance.

Diverse business resources

Our mortgage amortization table shows amortization by month and year. Your loan term and interest rate will remain the same, but your monthly payment will be lower. With fees around $200-$300, recasting can be a cheaper alternative to refinancing. First, it will calculate your monthly mortgage payment for any loan amount and interest rate.

Be sure to use a refinance calculator every time to understand the long-term cost or savings of the home loan. Amortization calculatorCurious how much you will pay to interest and principal each month? Use our amortization calculator to estimate your monthly principal and interest payments made over the life of a loan. A student loan is an unsecured loan from either the federal government or a private lender. If you don't have an established credit history, you may not find the best loan.

Amortization Schedule Calculator Overview

Your savings federally insured to at least $250,000 and backed by the full faith and credit of the United States Government National Credit Union Administration, a US Government Agency. Have an idea of what kind of loan is right for you before you apply. I declare that the information I have provided is accurate & complete to the best of my knowledge.

If you submit your information on this site, one or more of these companies will contact you with additional information regarding your request. By submitting your information you agree Mortgage Research Center can provide your information to one of these companies, who will then contact you. Mortgageloan.com will not charge, seek or accept fees of any kind from you. Mortgage products are not offered directly on the Mortgageloan.com website and if you are connected to a lender through Mortgageloan.com, specific terms and conditions from that lender will apply. A payday loan is a short-term loan that certain financial places offer to provide the borrower with cash to last them until the next payday.

Related Calculators

Say you are taking out a mortgage for $275,000 at 4.875% interest for 30 years . Enter these values into the calculator and click "Calculate" to produce an amortized schedule of monthly loan payments. You can see that the payment amount stays the same over the course of the mortgage. With each payment the principal owed is reduced and this results in a decreasing interest due.

This calculator tests different interest rates and term combinations; this helps you to have a suitable home loan. Normally, the range of home loan interest rates charged by the banks is 9.50% to 12.75%. The number you have suggested gets attributed with regard to the percentage value, thus you don’t need to enter the % marker. Use this amortization calculator to get an estimate of cost savings and more. Choose if you want your amortization report to show results on either a monthly or annual basis, then click "View Report" at the top of the page to see the full amortization table.

Use this amortization calculator to get an estimate of cost savings and more.

Transferring your outstanding home loan availed from another Bank / Financial Institution to HDFC is known as a balance transfer loan. An online EMI calculator is easily accessible online from anywhere. You can try various combinations of the input variable as many times as required to arrive at the right home loan amount, EMIs, and tenure best suited to your needs.

Foreclosure – The process of a mortgage lender repossessing the home because of contractual failure due to missed payments. In either case, our Mortgage Payment Calculator can help you by determining your payment and providing a complete amortization schedule for further analysis. If you're in the middle of a mortgage payment crisis, seek help through your mortgage lender and third parties. By starting on the right foot and making sure you can afford your mortgage payment, you won't have to worry about the consequences of not paying.

Be informed that your home loan application gets recorded in your CIBIL report. If you are applying for too many home loans simultaneously, it may affect your odds of getting a loan and in the worst cases can even surge the interest rate as well. If you are applying for multiple loans, it is a sheer signal of desperation to have a loan. While you decide on your loan amount, it is imperative to act smart and choose the loan amount that you are eligible for.

As the borrower approaches the end of the loan term, the bank will apply nearly all of the payment to reducing principal. Extra payments on a mortgage can be applied to the principal to reduce the amount of interest and shorten the amortization. To calculate amortization with an extra payment, simply add the extra payment to the principal payment for the month that the extra payment was made. Any additional extra payments throughout the loan term should be applied in the same way. Keep in mind, while you can pay off your principal early, in some cases there may be a pre-payment penalty for paying the loan off too early.

Enter the details of your existing and future loans to estimate your potential refinance savings. Bankrate’s mortgage calculator gives you a monthly payment estimate after you input the home price, your down payment, the interest rate and length of the loan term. You might discover you need to adjust your down payment to keep your monthly payments affordable. You can also see the loan amortization schedule, or how your debt is reduced over time with monthly principal and interest payments. If you want to pay off a mortgage before the loan term is over, you can use the calculator to figure out how much more you must pay each month to achieve your goal. The Bankrate loan calculator helps borrowers calculate amortized loans.

Additionally, shorter-term loans (i.e. 15-year fixed) typically have lower interest rates than those with longer terms (i.e. 30-year fixed). Use the calculator below to calculate your monthly home equity payment for the loan from Westfield Bank. You can adjust loan amount, interest rate, and the home equity term to view the impact on the monthly payment amount. The calculator also provides an amortization table to show the amount of principal and interest payments a borrower will make over the life of the loan. Using the online calculator, you can adjust the values easily and within a matter of seconds, you will get the exact values for different amortization schedules.

An amortized mortgage has equal monthly mortgage payments, so when the term of the mortgage comes to end the mortgage is paid in full. A personal loan is an unsecured, lump-sum loan that is repaid at a fixed rate over a specific period of time. The personal loan calculator lets you estimate your monthly payments based on how much you want to borrow, the interest rate, how much time you have to pay it back, your credit score and income. An installment loan is a loan that a bank has amortized over regular, equal payments. More precisely, it's a loan with a fixed interest rate, fixed monthly payment, and a fixed duration. Most mortgages, auto loans, and personal loans are installment loans.

Choose from calculators covering various aspects of mortgages, auto loans, investments, student loans, taxes, retirement planning and more. Mortgageloan.com is a product of ICB Solutions, a division of Neighbors Bank. ICB Solutions partners with a private company, Mortgage Research Center, LLC, (nmls # 1907), that provides mortgage information and connects homebuyers with lenders. Neither Mortgageloan.com, Mortgage Research Center nor ICB Solutions are endorsed by, sponsored by or affiliated with any government agency. ICB Solutions and Mortgage Research Center receive compensation for providing marketing services to a select group of companies involved in helping consumers find, buy or refinance homes.